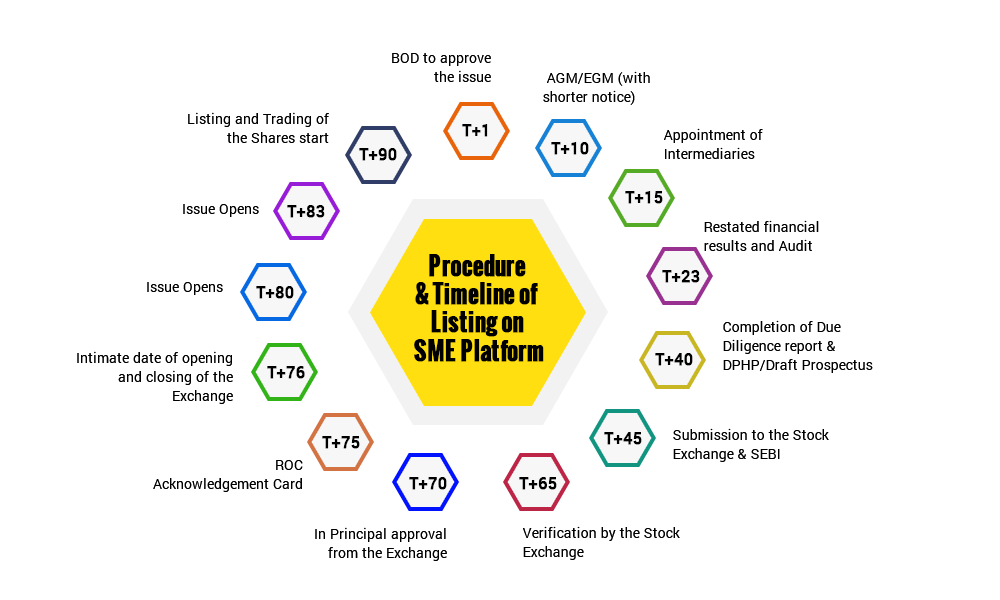

The Listing Process on SME Platform

Planning

The Issuer Company consults and appoints the Merchant Banker/s in an advisory capacity.

Preparation

The Merchant Banker prepares the documentation for filing after:

- conducting due diligence regarding the Company i.e checking the documentation including all the financial documents, material contracts, Government Approvals, Promoter details etc.

- and planning the IPO structure, share issuances, and financial requirements

Process

Application procedure:

- Submission of DRHP/Draft Prospectus - These documents are prepared by the Merchant Banker and filed with the Exchange as well as with SEBI as per requirements.

- Verification & Site Visit – Stock Exchange verifies the documents and processes the same. A visit to the company's site shall be undertaken by the Stock Exchange official. The Promoters are called for an interview with the Listing Advisory Committee.

- Approval – Stock Exchange issues an In Principle approval on the recommendation of the Committee, provided all the requirements are compiled by the Issuer Company.

- Filing of RHP/Prospectus - Merchant Banker files these documents with the ROC indicating the opening and closing date of the issue. Once approval is received from the ROC, they intimate the Stock Exchange regarding the opening dates of the issue along with the required documents.

Public Offering

The Initial Public Offer opens and closes as per schedule. After the closure of IPO, the Company submits the documents as per the checklist to the Exchange for finalization of the basis of allotment.

Post Listing

Stock Exchange finalizes the basis of allotment and issues the Notice regarding Listing and Trading.

Types of Issues: Fixed Price & Bookbuilding

There are two types of issues

Fixed Price issues

An issuer company is allowed to freely price the issue. The basis of issue price is disclosed in the offer document where the issuer discloses in detail about the qualitative and quantitative factors justifying the issue price. The Issuer company can mention a price band of 20% (cap in the price band should not be more than 20% of the floor price) in the Draft offer documents filed with SEBI and actual price can be determined at a later date before filing of the final offer document with SEBI/ROCs.

Price discovery through book building process.

“Book Building” means a process undertaken by which a demand for the securities proposed to be issued by a body corporate is elicited and built up and the price for the securities is assessed on the basis of the bids obtained for the quantum of securities offered for subscription by the issuer. This method provides an opportunity to the market to discover the price for securities. The process is named so because it refers to collection of bids from investors, which is based on a price range. The issue price is fixed after the closing date of the bid. A company planning an IPO appoints a merchant bank as a book runner. A particular time frame is fixed as the bidding period. The book runner then builds an order book that collates bids from various investors. Potential investors are allowed to revise their bids at any time during the bidding period. At the end of bidding period the order book is closed and consequently the quantum of shares ordered and the respective prices offered are known. The determination of final price is based on demand at various prices. Bookbuilding has become the preferred route of raising capital, as can be seen from the table below. Though there are fixed price issues, by amount, the bookbuilding IPOs dominate.

Eligibility Criteria for Listing on SME Platform of BSE and NSE

The following criteria should be complied with as on the date of filing the Public Offer Document with Stock Exchange as well as when the same is filed with ROC and SEBI.

| Parameter | Listing Criterion |

|---|---|

| Incorporation |

The Issuer should be a company incorporated under the Companies Act 1956 / 2013 in India. |

| Post Issue paid up Capital |

The post issue paid up capital of the company (face value) shall not be more than Rs. 25 crore. |

| Track record |

Track record of atleast three years of either: i. the applicant seeking listing; or ii. the promoters****/promoting company, incorporated in or outside India or iii. Proprietary / Partnership firm and subsequently converted into a Company (not in existence as a Company for three years) and approaches the Exchange for listing. ****Promoters mean one or more persons with minimum 3 years of experience in the same line of business and shall be holding at least 20% of the post issue equity share capital individually or severally The company/entity should have positive cash accruals (earnings before depreciation and tax) from operations for atleast 2 financial years preceding the application and its net-worth should be positive. |

| Other Listing conditions |

The applicant Company has not been referred to Board for Industrial and Financial Reconstruction (BIFR). No petition for winding up is admitted by a Court of competent jurisdiction against the applicant Company. No material regulatory or disciplinary action by a stock exchange or regulatory authority in the past three years against the applicant company. |

| Disclosures |

The following matters should be disclosed in the offer document : i. Any material regulatory or disciplinary action by a stock exchange or regulatory authority in the past one year in respect of promoters/promoting company(ies), group companies, companies promoted by the promoters/promoting company(ies) of the applicant company. ii. Defaults in respect of payment of interest and/or principal to the debenture/bond/fixed deposit holders, banks, FIs by the applicant, promoters/promoting company(ies), group companies, companies promoted by the promoters/promoting company(ies) during the past three years. An auditor's certificate shall also be provided by the issuer to the exchange, in this regard. iii. The applicant, promoters/promoting company(ies), group companies, companies promoted by the promoters/promoting company(ies) litigation record, the nature of litigation, and status of litigation. iv. In respect of the track record of the directors, the status of criminal cases filed or nature of the investigation being undertaken with regard to alleged commission of any offence by any of its directors and its effect on the business of the company, where all or any of the directors of issuer have or has been charge-sheeted with serious crimes like murder, rape, forgery, economic offences etc. |

| Other Requirements |

It is mandatory for a company to have a website. It is mandatory for the company to facilitate trading in demat securities and enter into an agreement with both the depositories. There should not be any change in the promoters of the company in preceding one year from date of filing the application to BSE for listing under SME segment. |

How does the SME platform differ from the main board?

- Companies with a post issue paid up capital ranging from Rs. 1 crore to Rs. 10 crore are eligible for the SME platform as compared to the main board where a paid up capital of Rs. 10 crore is mandatory.

- The listing norms of SMEs has been simplified. A merchant banker can file the Draft Red Herring Prospectus (DRHP) directly with the exchange and seek its approval. The in-principle approval from the market regulator SEBI and the public notice of one month is waived off in case of SME listing. As result the listing process can be completed in 2-3 months’ time as compared to a time frame of 8-9 months on the main board.

- Issue expenses are nominal for the SMEs and are restricted to advertisement and stationery.

- Underwriting, sub underwriting and market making charges are however charged to the issuer.

- SMEs are required to do half yearly compliance Instead of quarterly compliance.

- Market making is mandatory for a period of 3 years for any company listed on the SME exchange.

- The member brokers who are registered as “market makers” agree to support the scrip by providing two way quotes and act as market makers.

- The market makers are required to provide two way quotes for 75% of the time on a single trading day.

- At the time of allotment of shares in IPO and before commencing market making activity, the market makers are required to hold 5% of the specified scrip.

- The market makers can either buy or sell the required number of shares to the nominated investor.

- The merchant banker and the nominated investor must get into an agreement for the same.

- The Takeover Code of SEBI has put in stringent measures that can prevent SMEs from such events.

- Any acquisition of shares of 5% or above of a target company needs to be declared to the Stock Exchange and the company.

- Thereafter, any further acquisition or disposal of shares representing 2% or more of the target company must be declared to the Stock Exchange as well.

- Any acquisition that amounts to 25% or more shares of the target company, will require the acquirer to make an open offer to purchase 26% of the target company’s capital.

- The Takeover Code is not applicable to the market makers thus all market making activities are exempt from it.

- The Takeover code is applicable to all investors in an SME, so as to prevent a hostile takeover.

- If any fraudulent attempts for a hostile takeover is noticed, a promoter can report the same to the exchange.